Your 2025 Year-End Financial Checklist: Key Moves Before December 31

Your 2025 Year-End Financial Checklist: Key Moves Before December 31 As we close out the year, December is one of the most important months for financial planning. A few strategic steps now can strengthen your long-term outlook and ensure you’re entering 2026 with...

529 plans vs UTMAs

529 plans vs UTMAs When families begin saving for their children’s future, two popular options often come up: 529 college savings plans and UTMA custodial accounts. While both are designed to help transfer wealth to the next generation, they work very differently and...

What the One Big Beautiful Bill Act Means for Your Financial Plan

On July 4th, President Trump signed the “One Big Beautiful Bill Act” (BBB) into law, introducing wide-ranging changes to areas such as taxes, benefits, and savings. While much of the discussion has been political, our focus is on what it means for your financial plan....

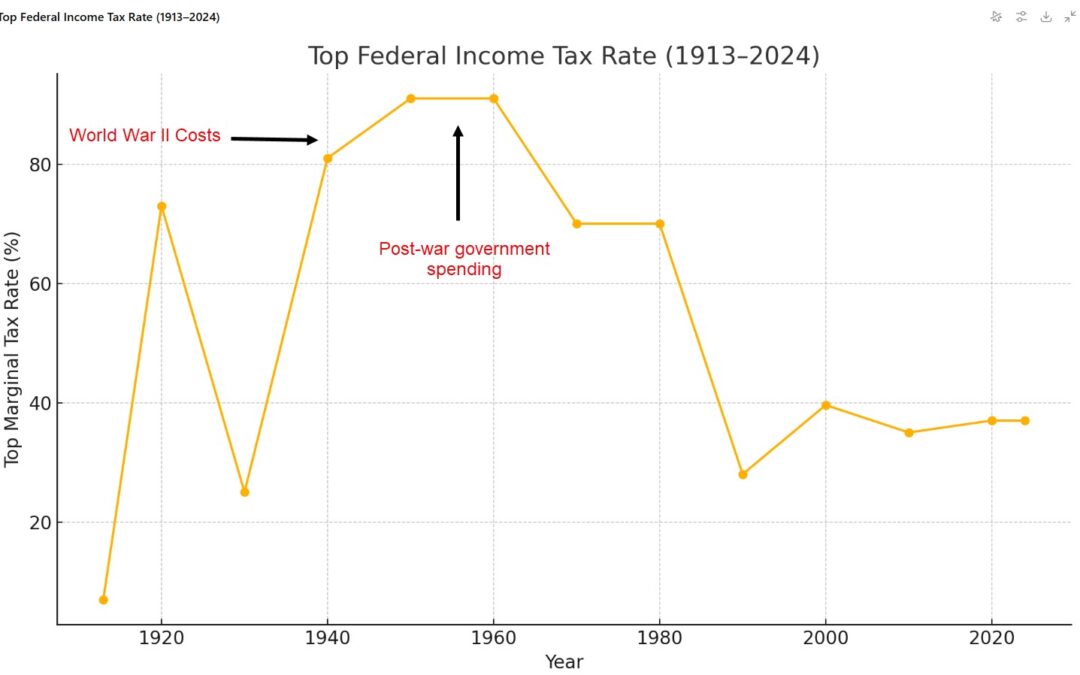

Should You Consider a Roth Conversion?

When planning for retirement, taxes can take a bigger bite out of your savings than you might expect. One way to stay ahead of this is by considering a Roth IRA conversion. Here’s how it works: you move money from a traditional IRA or 401(k) which hasn’t been taxed...

NUA Explained: A Powerful Tax Strategy for Retiring with Company Stock

If you’re approaching retirement and hold employer stock in your 401(k) or company retirement plan, there’s a little-known tax strategy that could save you significantly in taxes: Net Unrealized Appreciation (NUA). Many people assume rolling over their entire 401(k)...

Investing Through Uncertainty: Avoiding Emotional Decisions Amid Tariff News

With headlines dominated by trade tensions and new tariffs, it’s easy to feel the urge to react and make changes to your portfolio. However, history shows that emotional investment decisions often lead to costly mistakes. Before you decide to exit the market due to...

Tax Season

As tax season approaches, here’s a quick list of creative deductions business owners often overlook: 1. Online Advertising: Do you advertise on social media platforms like Facebook or Instagram? What about search engine ads, sponsored articles, or podcast...

Election Season

Election season brings noise that can feel overwhelming and anxiety-inducing, especially with concerns about its effect on the markets. However, many common fears about elections and investments are simply misconceptions. The first misconception is that presidential...

What Historical Data Has Shown with Interest Rate Cuts

In March of 2022, the Fed began its mission to combat lofty levels of inflation by raising interest rates at an aggressive pace unseen in decades. In fact, between March of 2022 and July of 2023, the Fed raised interest rates 11 times! Many forget that the Fed had...

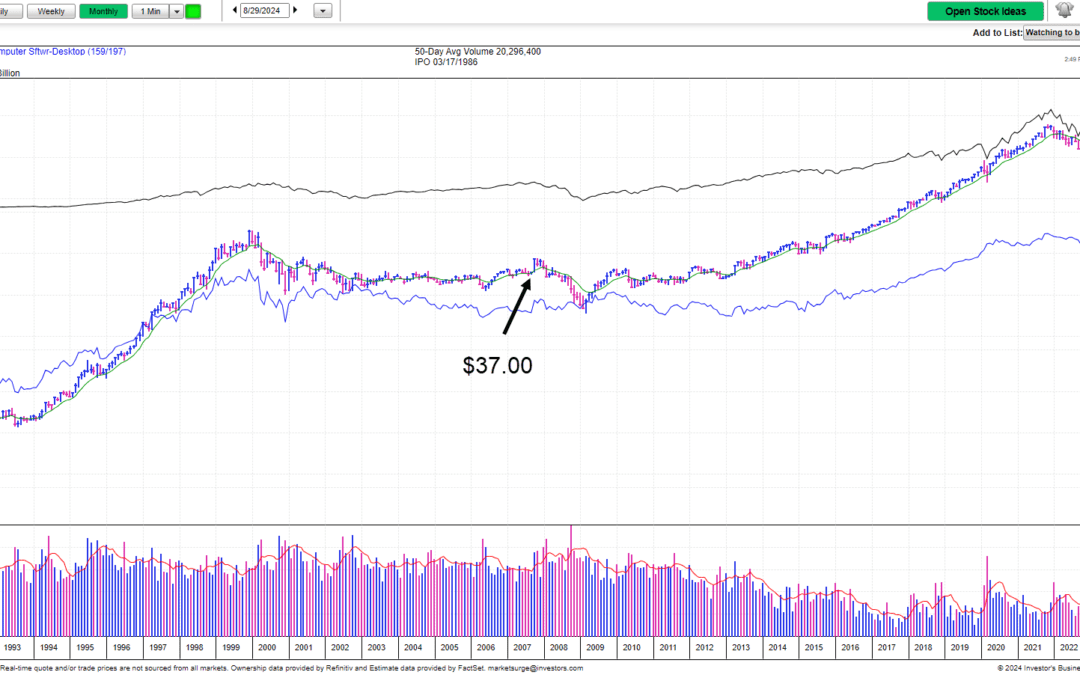

Holding Market Leaders

Does your portfolio hold today’s market leaders? Well, it should! Holding market leaders is a very effective strategy for building long-term wealth through the stock market. These companies typically have strong competitive advantages with the products/services...

We are nearing the end of a fantastic year for the stock market. It is not unusual for our clients to be up 20% this year. This is a good time to consider the following:

– Avoid taking unnecessary gains in taxable accounts. By waiting until January 1, you can push the tax obligation out into 2026.

· Take as many losses as you have in taxable accounts to save taxes in 2025.

· Have a strategy to protect your gains. Using stop-loss orders can help avoid giving back hard-fought profits.

· Consider switching from traditional mutual funds to exchange traded funds (ETFs) to control your gains better and likely reduce taxes. If you bought a Growth fund mid-year, and the fund decided to sell a stock it has held for years, you get to help pay taxes on those gains. This is not true for ETFs.

· Prepare a year end balance sheet measuring end-of-year balances on all assets and liabilities. This is an easy way to track your financial progress over time.