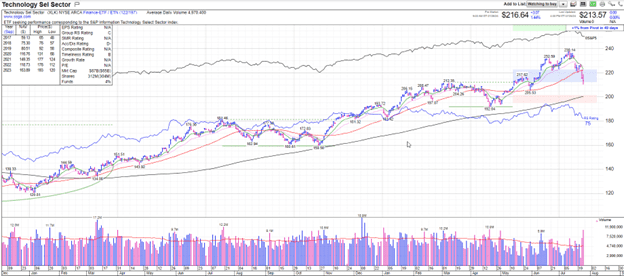

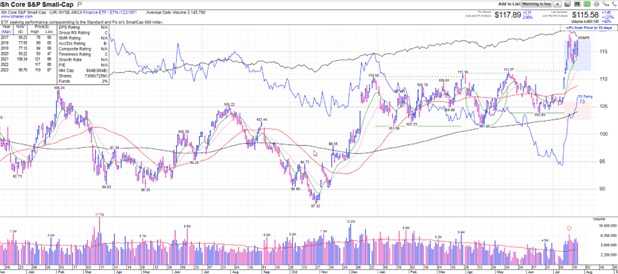

Recently we have seen a rotation from the technology stocks that has led the market into other areas, such as smaller and medium-sized companies. For example, Mohawk Industries, a mundane flooring manufacturer, is up over 24% in the last month, while Nvidia, the market darling of recent years, is down over 17% in recent weeks.

We’ve all heard the old saying “trees don’t grow to the sky.” Put into stock market parlance, it is unhealthy and unwise to think the tech stocks that have led the market will do so infinitely. The rotation to other segments of the market is healthy for investors.

*Technology Select Sector Index chart from MarketSurge

*iShares Core S&P Small-Cap Index chart from MarketSurge

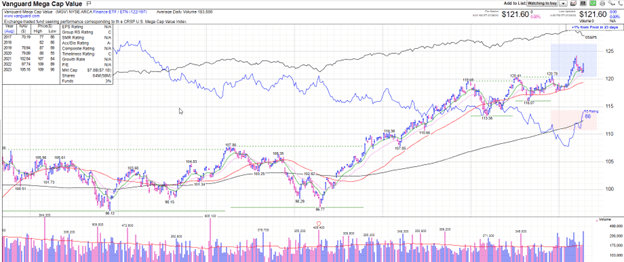

At Braeburn, we have started to allocate more exposure to these smaller and medium-sized companies but have also started moving into the large cap value space as well. This gives our clients exposure to large, financially stable companies like Berkshire Hathaway, Home Depot, and JP Morgan. The technology craze may not be as robust as it once was just months ago, but it’s important for other sectors of the market to start providing potential alternative avenues for long term growth.

*Vanguard Mega Cap Value Chart from MarketSurge